- What Are Mortgage Lenders?

- What Are Mortgage Originators?

- TILA

- RESPA

- Fair Housing Act (FHA)

- Equal Credit Opportunity Act (ECOA)

- Fair Credit Reporting Act (FCRA)

- Servicemembers Civil Relief Act (SCRA)

- Electronic Fund Transfer Act (EFTA)

- Home Mortgage Disclosure Act (HMDA)

- Home Ownership and Equity Protection Act (HOEPA)

- Flood Insurance

- SAFE Act

- False Claims Act

- Appraiser Independence Requirement (AIR)

- Anti-Money Laundering (AML)

Mortgage Lender vs. Mortgage Originators

To understand mortgage lender compliance, it is essential to distinguish between mortgage lenders and mortgage originators:

What Are Mortgage Lenders?

A mortgage lender is a mortgage bank or financial institution that lends funds to the borrower and is repaid the debt. The obligation to cover the price of the property is initially assigned to the lender at the settlement or immediately following the settlement.

Lenders must follow borrowing guidelines to verify a borrower’s creditworthiness and ability to pay back a loan. They set the interest rate, terms and repayment schedule of a mortgage. There are many different types of lenders:

- Direct lenders: A direct mortgage lender originates loans with their own funds or by borrowing the funds from elsewhere.

- Retail lenders: A retail lender offers loans to consumers directly.

- Portfolio lenders: A portfolio lender funds a borrower’s loan with their own funds.

- Warehouse lenders: A warehouse lender funds loans for other mortgage lenders through short-term funding.

- Wholesale lenders: A wholesale lender is a bank or other financial institution that doesn’t work with consumers directly, but it originates, funds and sometimes services loans.

- Hard money lenders: A hard money lender is typically an individual or private company with substantial cash reserves and is commonly the choice for a borrower who wants to flip a home.

- Correspondent lenders: A correspondent lender is the initial lender that makes the loan and may also service the loan.

Regardless of the services lenders offer, most are still required to comply with regulations.

What Are Mortgage Originators?

The mortgage originator is an individual or institution that accepts the mortgage loan application or offers the terms of a mortgage loan and negotiates the terms with the would-be borrower. As the name suggests, originators are the original mortgage lenders and can be mortgage bankers or mortgage brokers.

Originators play a role in the primary mortgage market and work with loan processors and underwriters from the application to closing, gathering the necessary documents and guiding the borrower’s file through every step of the approval process. The originator is essentially an intermediary between borrowers and lenders, and they are not in control of the borrowing timeline, guidelines or final approval.

Truth in Lending Act and Real Estate Settlement Procedures Act

A crucial part of regulatory compliance is understanding whether a loan is subject to the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA). With their combined regulations, TILA and RESPA impose several disclosures and compliance obligations on a mortgage lender, such as:

- The Home Ownership and Equity Protection Act (HOEPA)

- The Ability-to-Repay/Qualified Mortgage (ATR/QM) Rule

- The Loan Originator Compensation (LO Comp) Rule

- The TILA-RESPA Integrated Disclosure (TRID)

These requirements won’t apply to loans exempt from TILA and RESPA coverage. If a lender incorrectly categorizes a loan as exempt, this could lead to stiff penalties. Accordingly, a lender should be careful and pay close attention when determining whether RESPA and TILA apply to a loan.

TILA

The Truth in Lending Act ensures consumers are protected from unfair and inaccurate credit card practices and credit billing. Under TILA, a lender must provide consumers with loan cost information that can be used for comparison shopping. The act specifies which information needs to be disclosed to borrowers before credit can be extended, such as the loan term, total costs and the annual percentage rate (APR).

Typically, TILA applies to an extension of consumer credit that is used for a household, family or personal purpose. Certain kinds of credit extensions are exempt under TILA. For a business-purpose lender, you should consider two crucial TILA exemptions:

- A loan to a non-natural person is exempt, meaning TILA won’t apply if a loan is extended to an entity rather than an individual.

- A loan primarily for a commercial or business purpose is exempt, though there are some nuances to this exemption.

To determine whether a loan is used for a business purpose, the creditor should evaluate the following factors:

- The transaction’s size

- To what degree the borrower will manage the acquisition

- The statement from the borrower about the purpose of the loan

- The relationship of the acquisition to the borrower’s primary occupation

- The ratio of the borrower’s total income to the income from the acquisition

For a rental property not occupied by the owner, a loan to acquire, maintain or improve this type of property will always be considered a loan for business purposes.

RESPA

In 1975, the Real Estate Settlement Procedures Act became effective. RESPA was implemented to prohibit kickbacks, restrict the use of escrow accounts and eliminate abusive practices in the process of a real estate settlement. RESPA also provides sellers and homebuyers with disclosures on complete settlement costs.

Under RESPA, a home loan lender must provide borrowers with disclosures concerning settlement services, consumer protection laws and real estate transactions. RESPA applies to most refinances, purchase loans, equity lines of credit and property improvement loans.

The exemptions under RESPA differ. RESPA’s implementing regulation is Regulation X and doesn’t include an exemption for loans borrowed by non-natural persons. However, under RESPA, a loan primarily used for a commercial or business purpose is exempt, and Regulation Z defines how the determination is made for loans to non-natural persons.

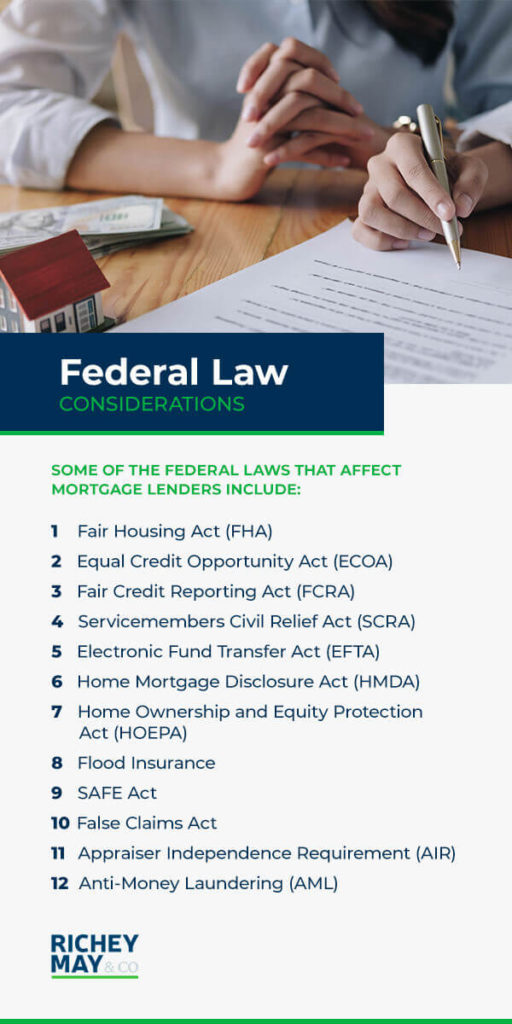

Federal Law Considerations

Fair lending laws are considered regardless of whether a loan is being acquired for an investment property and whether the borrower is an individual or corporate entity. Even if a loan is exempt from RESPA and TILA, other consumer financial laws could still be applicable. Some of the federal laws that affect mortgage lenders include those listed below. Please note that federal regulations can change frequently and this list is not fully comprehensive. Always consult a compliance professional with regard to regulatory compliance.

1. Fair Housing Act (FHA)

The FHA applies to any entity or person whose business engages in transactions related to residential real estate, including the purchasing or making of loans or offering other financial assistance. Other financial assistance can be for a loan secured by residential real estate or for the purchase, improvement, construction, maintenance or repair of a dwelling. Additionally, the FHA applies to the appraising, brokering or selling of residential real property.

2. Equal Credit Opportunity Act (ECOA)

Similar to the FHA, the ECOA applies widely to business and consumer credit, imposing notice and nondiscrimination requirements to every type of credit. In some limited circumstances, the FHA and ECOA can both apply to the creditor’s assignees and purchasers. Under the ECOA, discrimination is prohibited in any part of a credit transaction. Discrimination based on any of the following is prohibited:

- Sex

- Age

- Religion

- Race or color

- Marital status

- National origin

Due to the collateral of the loan rather than the loan’s purpose, other requirements may come into play. Under the ECOA, the valuation requirements require creditors to furnish a copy of the appraisal and other valuations to applications and apply to any credit applications to be secured by a first lien, regardless of whether the credit is for a consumer or business purpose.

3. Fair Credit Reporting Act (FCRA)

The FCRA doesn’t govern commercial or business credit reports, but it does impose adverse action and permissible purpose requirements on users of consumer reports. If a lender obtains consumer reports on co-applicants, guarantors and principals, it should be mindful that the act may still apply if a consumer report is used with a commercial or business transaction.

4. Servicemembers Civil Relief Act (SCRA)

The Servicemembers Civil Relief Act (SCRA) was designed to relieve servicemembers of some financial burdens during a period of military service. This federal law provides protections for a military member who is entering active duty and covers several financial issues, such as:

- Evictions

- Prepaid rent

- Life insurance

- Health insurance

- Security deposits

- Rental agreements

- Automobile leases

- Income tax payments

- Installment contracts

- Mortgage foreclosures

- Mortgage interest rates

- Credit card interest rates

- Civil judicial proceedings

The Attorney General can file a federal lawsuit under the SCRA against any entity or person who engages in a practice or pattern of violating this law.

5. Electronic Fund Transfer Act (EFTA)

The Electronic Fund Transfer Act (EFTA) protects consumers during the electronic transfer of funds (EFTs), including through ATMs, point-of-sale terminals, automatic withdrawals from bank accounts and the use of debit cards. This act was enacted after the use of ATMs increased to offer more protection to consumers. The EFTA also provides the means to correct transaction errors, along with limiting the liability that results from a stolen or lost card.

6. Home Mortgage Disclosure Act (HMDA)

Another federal law consideration is the Home Mortgage Disclosure Act (HMDA). Under the implementing regulation of HMDA, Regulation C, an open-end line of credit or a closed-end mortgage loan made primarily for business purposes is considered an excluded transaction. Mortgage companies must report data to their regulators that illustrates whether they provide credit in the area where their offices are located. Additionally, this data enables government officials to target investment dollars to locations that most need growth investments.

However, this exclusion doesn’t apply if the line of credit or loan meets the definition under Regulation C of a home improvement loan, home purchase loan or refinancing. As a result, an open-end line of credit or a closed-end mortgage loan to improve, purchase or refinance a multifamily dwelling or single-family investment property is not excluded from HMDA reporting on the grounds of a business purpose.

7. Home Ownership and Equity Protection Act (HOEPA)

In 1994, HOEPA was established to amend the TILA to prevent improper practices in closed-end home equity loans and refinances with high fees or high interest rates. Under the HOEPA, mortgages should provide the consumer with additional information if they are buying a high-cost home. HOEPA covers various types of mortgages, including:

- Refinance

- Purchase-money

- Open-end credit plans

- Closed-end home equity loans

8. Flood Insurance

The location and type of collateral determine how flood insurance laws may apply, regardless of the loan’s business purpose. The Flood Insurance Reform Act provides disincentives that discourage property owners from living in an area prone to floods. Under this act, flood insurance premiums are tied to flood risk, which means property owners in a flood-prone area will likely pay higher premiums.

According to this federal law, lenders must use flood insurance maps to determine whether a property a borrower wants to buy is in a flood plain. If so, the borrower needs to purchase flood insurance as added protection for their investment interest.

9. SAFE Act

The Secure and Fair Enforcement for Mortgage Licensing (SAFE) Act was enacted on July 30, 2008, and mandates a nationwide licensing and registration system for residential mortgage loan originators (MLOs). The goal of the SAFE Act was to increase accountability and consumer protection in the mortgage industry as overseen by the Consumer Financial Protection Bureau (CFPB).

It requires MLOs to register and renew an annual unique identifier, also known as an NMLS number. State licenses are also required in the states where that MLO can process mortgage applications. In many cases, these identifiers are required to be listed in a specific manner on advertisements and marketing materials.

10. False Claims Act

The False Claims Act protects the federal government — and by extension, the taxpayer — from paying out agency money for false or fraudulent claims. In the context of mortgages, this typically applies to FHA or Housing and Urban Development (HUD) programs, as these are backed by the federal government via those agencies. In this context, lenders must ensure that loans they originate under these programs conform to the guidelines set for that particular loan type. Attempts to get loans covered by federal insurance when they don’t meet the guidelines can result in a DOJ investigation and a financial penalty.

11. Appraiser Independence Requirement (AIR)

Appraiser Independence Requirements were developed by the Federal Housing Finance Agency (FHFA), Fannie Mae, Freddie Mac and others and went into effect in 2010. AIR requires appraisers to be licensed by the state where they practice and covers conventional, single-family homes sold to Fannie Mae or Freddie Mac.

AIR essentially requires lenders and Realtors to remain separate from the appraisers to prevent the relationship — and desire to close the loan for a certain price — from affecting the quality of the appraisal report and home valuation. Many lenders use a pre-approved list where someone that is not a member of the loan production staff selects an appraiser to complete the home review in the target closing time of the loan. Freddie Mac provides a convenient FAQ for definitions and clarification involved with this regulation.

12. Anti-Money Laundering (AML)

Many financial institutions, including mortgage bankers, must comply with the Bank Secrecy Act (BSA) and its Anti-Money Laundering rules. This helps the Financial Industry Regulatory Authority (FINRA) set standards to monitor and prevent possible cases of money laundering and other suspicious activity. FINRA Rule 3310 sets minimum standards for AML programs for lenders that are spelled out in its guidelines. Many lenders choose to outsource these programs, including with Richey May.

State Law Considerations

Along with federal law considerations, there are also state-by-state regulations that affect a mortgage lender. In some states, a mortgage lender is required to obtain licensure to make loans secured by residential real property, no matter whether the loans are for a business or consumer purpose. Since the requirements vary from state to state, a mortgage lender should thoroughly review and consider the licensing requirements of each jurisdiction in which they conduct business.

Other state laws that govern several parts of residential mortgage lending may apply to loans with a business purpose. A mortgage lender should always be mindful of state laws that govern predatory lending and high-cost loans, which tend to be more expansive than HOEPA. Even though these laws usually apply to consumer-purpose loans or owner-occupied properties, this is why it is crucial for a mortgage lender to verify and document a transaction’s purpose.

Get Help With Mortgage Lending Compliance

Staying in compliance with regulations is important for any business, especially for mortgage lenders. At Richey May, we can be a valued financial advisor. We are a full-service accounting and business advisory firm, and we focus on providing our customers the best possible service. We are responsive, honest and dependable. As a team, we will work together to help you achieve success.

Our services include mortgage consulting, assurance, financial services, insights, business advisory and technology solutions. We work with clients across a wide array of industries, including mortgage banking, alternative investments, commercial finance and media and entertainment. To discuss your needs with one of our professionals, contact us today for more information.